Homeownership comes with many responsibilities, including protecting your investment through a homeowners insurance policy. This kind of coverage provides financial support when damage occurs due to fire, storms, theft, or other unexpected events. However, one issue that can leave homeowners feeling uncertain is the cancellation of their insurance policy. If you’re dealing with a homeowners insurance policy cancellation in Oklahoma, it’s important to understand your rights and what actions you can take.

At 222 Injury Lawyers, we often hear from homeowners confused and frustrated after receiving a cancellation notice. So, let’s break down what Oklahoma law says, how insurance companies must operate, and what you can do if your policy is canceled.

The Difference Between Cancellation and Non-Renewal

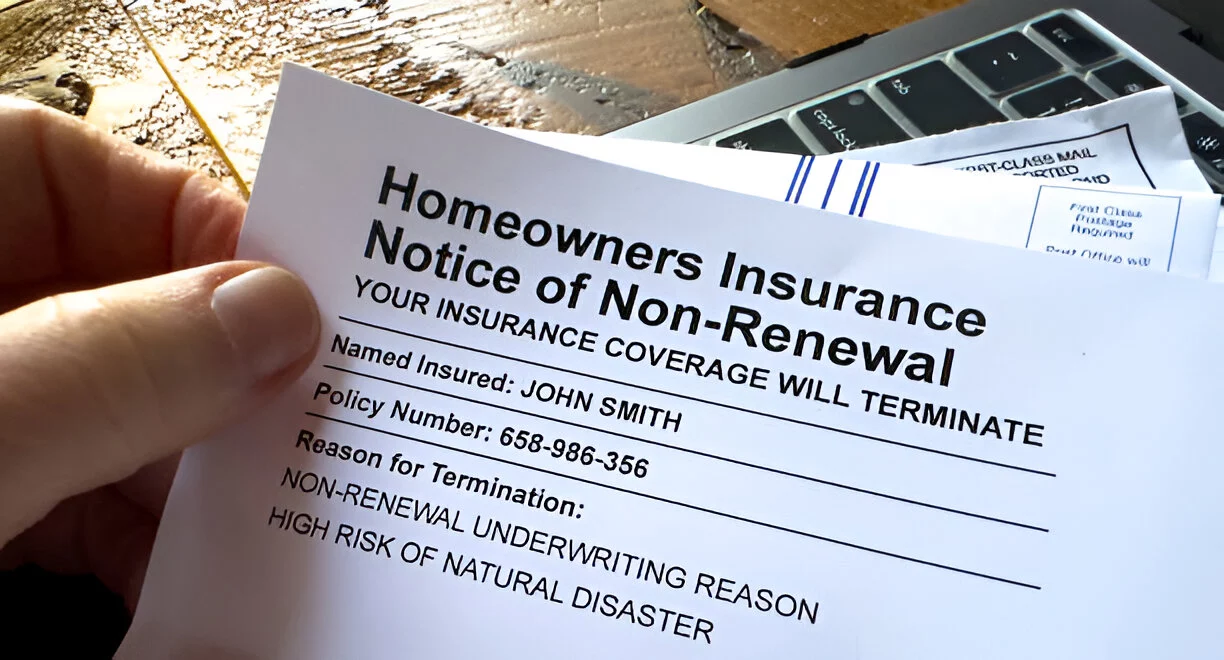

The first thing you should know is the difference between a policy being canceled and one simply not being renewed. Cancellation usually happens mid-policy—often due to missed payments, fraud, or significant risk changes to the property. Non-renewal, on the other hand, occurs at the end of your policy term when the insurer decides not to offer another year of coverage. While they may seem similar, your rights differ depending on which situation applies.

In Oklahoma, insurance companies must follow specific guidelines before they cancel your policy. A homeowners insurance policy cancellation can’t be arbitrary. There must be a valid reason, and you must be given proper notice before the cancellation takes effect. If you believe your policy was canceled unfairly, you may have legal options.

Valid Reasons for Cancellation in Oklahoma

Under Oklahoma law, an insurance company can cancel your homeowners policy within the first 60 days for almost any reason, as long as it’s not discriminatory. After the first 60 days, they can only cancel for specific reasons. These include failing to pay premiums, committing insurance fraud, or if there has been a significant increase in risk—such as making unauthorized changes to your home that increase the likelihood of damage.

If your homeowners insurance policy cancellation was due to non-payment, you should have received a written notice, often at least ten days before the policy ends. For other reasons, such as misrepresentation on your application or newly discovered risk factors, a 30-day notice is typically required.

This notice must include the reason for cancellation and information about your rights. If you didn’t receive this kind of documentation, the cancellation might be legally disputable.

Your Right to Written Notice and Appeal

Oklahoma law gives you the right to receive written notice of cancellation, which outlines the reason and date the policy will be canceled. This gives you a window of time to respond—either by fixing the issue, contacting the insurer for more information, or seeking legal guidance.

If you believe your policy was canceled unfairly, you can file a complaint with the Oklahoma Insurance Department. They can review your case to determine whether the insurance provider followed the law. In many situations, homeowners find that their cancellation was improper, and the Insurance Department may take corrective action on their behalf.

Another option is to get legal advice to explore whether a lawsuit may be necessary. Sometimes, cancellations happen because of insurance company mistakes, miscommunication, or unfair underwriting practices. At 222 Injury Lawyers, we’ve seen cases where homeowners were able to reverse the decision or receive compensation for losses that occurred after an improper cancellation.

When You Can Be Dropped for Too Many Claims

It’s also worth noting that even if you’ve paid your premiums on time, filing too many claims can put your coverage at risk. Some insurance companies view multiple claims—especially within a short period—as a sign that your home is too high-risk.

While it’s within the insurer’s rights not to renew your policy based on this reasoning, mid-term cancellations due to claims are more restricted. If you’re facing homeowners insurance policy cancellation due to repeated claims, you still have the right to receive notice and a clear explanation. You also have the right to shop around for other providers and appeal the decision if you believe you’ve been treated unfairly.

What to Do After a Cancellation Notice

If you’ve received notice of a homeowners insurance policy cancellation in Oklahoma, don’t panic. First, carefully review the reason listed. If the issue is something you can correct—such as an unpaid bill or missing documentation—address it right away and notify your insurer.

If the cancellation seems unwarranted or doesn’t provide enough detail, reach out to the insurance company and request clarification. It’s always best to communicate in writing and document every interaction. If the insurer won’t reinstate your policy, it may be time to involve legal help or contact the Oklahoma Insurance Department.

In the meantime, don’t wait to secure a new policy. A lapse in coverage can leave you financially vulnerable and may even violate your mortgage agreement. Compare quotes from different providers and apply for new insurance as soon as possible. Some companies even specialize in high-risk homeowners or offer temporary coverage while you resolve your original policy issue.

How We Can Help You

We understand how unsettling it can be to face the cancellation of something as essential as homeowners insurance. We’re here to help you understand your rights, assess whether the cancellation followed proper legal procedures, and take action if your policy was unfairly terminated.

Our team can review your policy, cancellation notice, and any communication you’ve had with the insurance company. If we identify a legal violation or breach of contract, we’ll guide you through your next steps—whether that’s filing a complaint with state regulators or pursuing compensation through legal action.

Oklahoma law is clear about the protections homeowners are entitled to, but not every insurance company plays fair. That’s where we step in. We’re committed to helping Oklahoma residents protect their homes, their rights, and their peace of mind.

Conclusion

Dealing with a homeowners insurance policy cancellation in Oklahoma can be stressful, but it doesn’t have to leave you feeling powerless. Knowing your rights under state law, understanding the required notice periods, and seeking professional legal help can go a long way in protecting your home and your future.

If your coverage has been dropped and you believe something isn’t right, contact 222 Injury Lawyers today. We’re ready to fight for your rights and help ensure you’re not left in the dark by your insurance provider.

Lexy Summer is a talented writer with a deep passion for the art of language and storytelling. With a background in editing and content creation, Lexy has honed her skills in crafting clear, engaging, and grammatically flawless writing.