There are many types of mutual funds, and one of them is Arbitrage Funds. Arbitrage Funds are the mutual funds that allow you to capitalize on price differences between cash and futures markets. Investing in arbitrage funds can help you generate returns with comparatively lower risk involved to direct equity investments. If you are looking to learn how arbitrage funds work, then you are at the right place. In this blog, we’ll describe how arbitrage funds work, considering newbies in the market. Without any further delay, let’s understand how arbitrage funds work.

What are Arbitrage Funds?

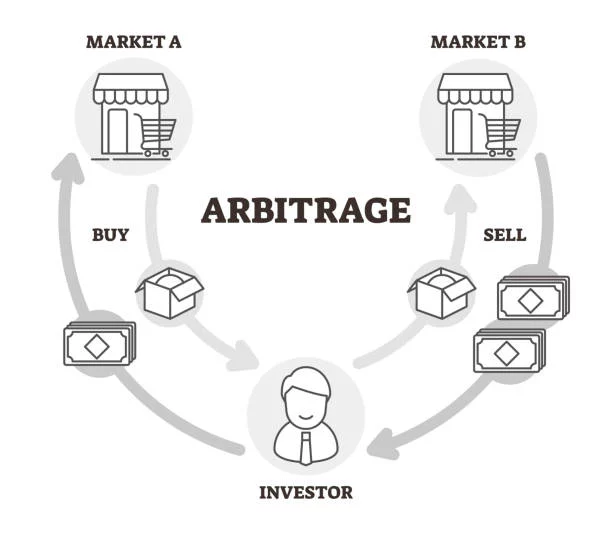

Arbitrage mutual funds refer to a type of hybrid mutual fund that allows you to capitalize on the price differences between markets, including cash and futures, to generate returns.

Simply put, in arbitrage funds, the appointed fund manager simultaneously buys and sells the same security in these markets to earn profit from price discrepancies. Hence, this strategy can help you generate low returns with low risk involved.

The fundamental concept of Arbitrage Funds significantly differs from investing, where you buy securities and hold them until they grow to sell them for later profit.

You must know that you receive a very minimal amount in a single position while dealing in arbitrage funds. Thus, it enables fund managers to make numerous trades in a day to generate substantial profits. There are many arbitrage funds in the market, such as Kotak Arbitrage Fund, Tata Arbitrage Fund Direct, Axis Arbitrage Fund Direct, and more.

Features of Arbitrage Funds

Here we’ve mentioned some vital features of arbitrage funds.

- Equity-Oriented: Arbitrage funds invest primarily in equities (minimum 65%) and equity-related instruments.

- Offer Hedge Exposure: These funds entail hedging strategies that reduce their risk levels.

- Tax Efficiency: Taxes are exempt till ₹1.25 lakh, beyond that, short-term capital gains are taxed at 20%, and long-term capital gains (when investments are held for more than a year) are taxed only at 12.50%.

- Suitable for Volatile Market: Arbitrage funds are low-risk investment options that can help you earn returns during volatile or unstable market conditions.

- Low-Risk Funds: The funds generally hold lower risk because they are aimed at generating profit from price discrepancies rather than directional market movements.

- Moderate Returns: The returns generated from arbitrage funds are more predictable and consistent than those generated by direct equity funds.

How Does Arbitrage Fund Work?

Let’s understand how a fund manager leverages arbitrage opportunities to book profits with lower risk in simple language.

Suppose the X company’s equity share is trading at ₹1000 and ₹1050 in the Cash and Future markets, respectively. And, if the Fund Manager spots this price difference, he will take advantage. The fund manager may buy X company’s shares at ₹1000 from the cash market and immediately set a future contract (in the futures market) to sell them at ₹1050.

When the shares are sold at month end, the fund manager will book a reasonable profit of ₹50 per share (reducing transaction costs) with minimal risk. This is a very simple example. Since fund managers manage a large pool of investments and assets, their job is quite complex and intensive.

These funds are suitable for conservative investors looking to invest their money for a short-to-medium term with an aim to generate moderate returns. They also suit investors who are looking for options to diversify their portfolio.

Conclusion

In summary, arbitrage funds allow you to book profits by exploiting price differences between two market segments. However, be sure to choose the right funds to ensure they match your goals and risk appetite.

Lexy Summer is a talented writer with a deep passion for the art of language and storytelling. With a background in editing and content creation, Lexy has honed her skills in crafting clear, engaging, and grammatically flawless writing.